In today’s digital era, credit card payment processing has become an integral part of businesses across various industries. From retail stores to e-commerce websites, efficient payment processing is essential for smooth transactions and enhanced customer satisfaction.

Importance of Efficient Payment Processing

Simplifying Transactions

Efficient credit card payment processing simplifies transactions for both businesses and customers. With quick and secure payment methods, customers can complete purchases seamlessly, leading to increased sales and revenue for businesses.

Enhancing Customer Experience

A smooth payment process contributes to a positive customer experience. Long gone are the days of cumbersome cash transactions. With credit card payments, customers enjoy the convenience of swift transactions, leading to higher satisfaction and loyalty.

Reducing Fraud Risks

Effective payment processing systems incorporate advanced security measures to mitigate fraud risks. From encryption to real-time fraud detection tools, businesses can safeguard sensitive financial information and protect against fraudulent activities.

Understanding the Credit Card Payment Process

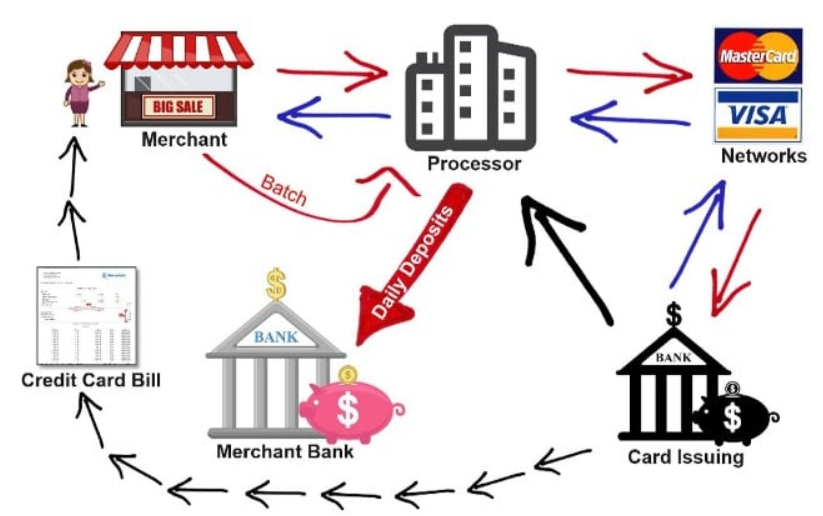

The credit card payment process involves several stages, each essential for completing a transaction successfully.

Authorization

When a customer initiates a transaction, the merchant sends a request for authorization to the payment processor. This step verifies the cardholder’s details and confirms whether the transaction can proceed.

Batching

Throughout the day, merchants accumulate authorized transactions into batches. Batching simplifies the process of settlement and reconciliation at the end of the day.

Clearing

During clearing, the payment processor sends authorized transactions to the card networks (e.g., Visa, Mastercard) for processing. The card networks communicate with the cardholder’s bank to verify available funds and approve the transaction.

Settlement

Settlement involves transferring funds from the cardholder’s bank to the merchant’s account. This step completes the transaction, and the merchant receives payment for the goods or services provided.

Types of Credit Card Processing Methods

Point of Sale (POS)

Traditional brick-and-mortar stores utilize POS systems to accept credit card payments. These systems often include card readers or terminals that facilitate in-person transactions.

Online Payment Gateways

E-commerce websites rely on online payment gateways to process credit card payments securely. Payment gateways encrypt sensitive information to protect it from unauthorized access during online transactions.

Mobile Payments

With the rise of smartphones, mobile payments have gained popularity. Mobile payment apps allow users to link their credit cards and make purchases conveniently using their mobile devices.

Virtual Terminals

Virtual terminals enable businesses to accept credit card payments without physical card readers. Instead, merchants manually enter card details into a secure online portal to process transactions.

Choosing the Right Payment Processor

Selecting the right payment processor is crucial for businesses to ensure smooth and secure transactions.

Fees and Costs

Consider the fees associated with credit card processing, including transaction fees, monthly service fees, and chargeback fees. Compare pricing structures to find a provider that offers competitive rates without compromising on service quality.

Security Measures

Prioritize payment processors that prioritize security measures such as encryption, tokenization, and PCI compliance. Robust security protocols safeguard sensitive financial data and protect against data breaches and fraud.

Integration Capabilities

Choose a payment processor that seamlessly integrates with your existing systems and software. Whether it’s an e-commerce platform or accounting software, compatibility ensures smooth operation and efficient payment processing.

Customer Support

Reliable customer support is essential for resolving issues and addressing concerns promptly. Look for payment processors that offer responsive customer support via phone, email, or live chat to ensure timely assistance when needed.

Trends in Credit Card Payment Processing

Contactless Payments

Contactless payments, enabled by Near Field Communication (NFC) technology, allow customers to make transactions by simply tapping their cards or mobile devices on a compatible terminal. This trend promotes faster checkout experiences and reduces physical contact, especially in the wake of the COVID-19 pandemic.

Biometric Authentication

Biometric authentication methods, such as fingerprint and facial recognition, add an extra layer of security to credit card transactions. By utilizing unique biological identifiers, businesses can enhance security and prevent unauthorized access to sensitive financial information.

Tokenization

Tokenization replaces sensitive card data with unique tokens, making it virtually impossible for hackers to intercept and misuse information during transactions. This technology enhances data security and reduces the risk of payment fraud.

Importance of Security in Payment Processing

Ensuring the security of credit card transactions is paramount to protect both businesses and customers from fraud and data breaches.

PCI Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance ensures that businesses adhere to stringent security standards when handling credit card information. Compliance reduces the risk of data breaches and helps maintain customer trust.

Encryption

Encryption scrambles sensitive data, such as credit card numbers and personal information, into unreadable code during transmission. This encryption process prevents unauthorized access and protects against data theft.

Fraud Detection Tools

Implementing fraud detection tools and algorithms can help businesses identify and prevent fraudulent transactions in real-time. Machine learning algorithms analyze transaction patterns and behavior to flag suspicious activities and mitigate risks.

Challenges and Solutions in Credit Card Processing

Chargebacks

Chargebacks occur when customers dispute transactions with their card issuers, leading to funds being reversed from the merchant’s account. Implementing robust fraud prevention measures and providing excellent customer service can help reduce chargeback rates.

Payment Gateway Downtime

Downtime or technical issues with payment gateways can disrupt business operations and lead to lost sales. To mitigate this risk, businesses should choose reliable payment processors with minimal downtime and invest in backup systems to ensure continuity.

Data Security Concerns

Data breaches pose significant risks to businesses, resulting in financial losses and reputational damage. By prioritizing data security measures such as encryption, tokenization, and regular security audits, businesses can protect sensitive customer information and maintain trust.

Future of Credit Card Payment Processing

Blockchain Technology

Blockchain technology has the potential to revolutionize credit card payment processing by offering decentralized and transparent transaction networks. With blockchain, transactions can be executed securely and efficiently without the need for intermediaries.

Artificial Intelligence

Artificial intelligence (AI) algorithms can enhance fraud detection and prevention in credit card transactions. By analyzing vast amounts of data in real-time, AI-powered systems can identify patterns and anomalies indicative of fraudulent activities, thereby reducing risks and enhancing security.

Enhanced Data Analytics

Advanced data analytics tools enable businesses to gain valuable insights into customer behavior and preferences. By leveraging data analytics, businesses can optimize pricing strategies, personalize marketing campaigns, and improve overall customer satisfaction.

Conclusion

In conclusion, credit card payment processing plays a pivotal role in today’s digital economy, enabling businesses to facilitate seamless transactions and enhance customer satisfaction. By understanding the intricacies of payment processing, implementing robust security measures, and embracing emerging technologies, businesses can stay ahead of the curve and drive growth in an increasingly competitive marketplace.